Equity Selection Strategies

Clarus' Equity Selection Strategies are a series of actively managed, proprietary, individual stock portfolios. Each of the offerings utilizes a distinct equity selection methodology designed to appeal to a wide variety of investors. The portfolios are unique to Clarus and employ management styles not commonly found at traditional Wall Street firms.

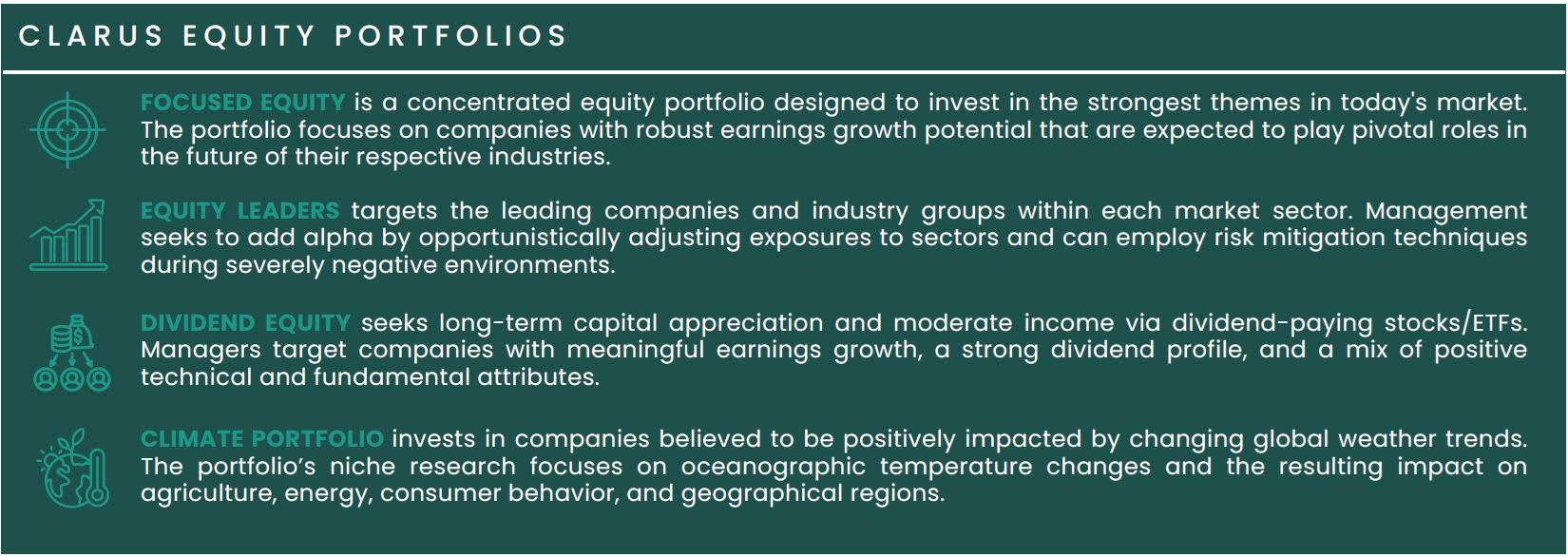

Focused Equity | Minimum: $50,000 | Manager: Don Moenning | Info Sheet (PDF)

The Equity Leaders portfolio is a risk-managed, individual equity/ETF portfolio designed to own the top-rated (as defined by a proprietary measure of company/industry performance and earnings strength) stocks in each S&P 500 sector while overweighting exposure to leading sectors and underweighting exposure to lagging sectors. Equity Leaders owns a mix of top-rated individual equities, sector ETFs, and sub-industry ETFs. Allocations and sector weightings are discretionary, though decisions are guided by a proprietary sector ranking system. The portfolio is risk-managed, with the ability to raise cash in severely negative market conditions. Risk level is considered to be aggressive. Typical allocation: 40% - 100% Equity.

Equity Leaders | Minimum: $100,000 | Manager: Don Moenning | Info Sheet (PDF)

The Equity Leaders portfolio is a risk-managed, individual equity/ETF portfolio designed to own the top-rated (as defined by a proprietary measure of company/industry performance and earnings strength) stocks in each S&P 500 sector while overweighting exposure to leading sectors and underweighting exposure to lagging sectors. Equity Leaders owns a mix of top-rated individual equities, sector ETFs, and sub-industry ETFs. Allocations and sector weightings are discretionary, though decisions are guided by a proprietary sector ranking system. The portfolio is risk-managed, with the ability to raise cash in severely negative market conditions. Risk level is considered to be aggressive. Typical allocation: 40% - 100% Equity.

Dividend Equity | Minimum: $50,000 | Manager: Don Moenning | Info Sheet (PDF)

The Dividend Equity portfolio is a large-cap, individual equity/ETF portfolio designed to own dividend-paying stocks. The portfolio strives to provide long-term capital appreciation with a modest degree of income. The Dividend Equity portfolio targets dividend paying stocks, primarily those that have increased their annual dividend payouts over long-term (5+ year) periods, have experienced notable earnings growth, and/or have attractive technical and fundamental setups. In addition to holding individual dividend-paying stocks, the portfolio holds 20% of its total exposure in Dividend ETFs, which may provide more predictable returns and less performance variance. Risk level is considered to be moderately aggressive. Typical allocation: 100% Equity.

Climate Portfolio | Minimum: $100,000 | Manager: Ken Hartley | Info Sheet (PDF)

The objective of the Climate Portfolio is to seek positive, risk-adjusted returns by investing in companies that may be impacted by changing weather trends, globally. The portfolio will utilize third-party research, specializing in oceanographic temperature changes and the impact on global weather patterns. The portfolio seeks to invest ahead of major, sustainable changes to regional and global weather patterns. The portfolio focuses in four areas: Agriculture, Energy (carbon based and alternative), Consumer Behavior, Major Regional Impact. The portfolio is market capitalization agnostic. The portfolio can have both long and short positions at any time. The portfolio turnover will tend to be low except in periods of extreme market volatility or adverse weather anomalies. Typical Allocation: 100% Equity.