MMP+ Portfolios | Multi-Strategy, Multi-Manager Blended Portfolios

In times of market stress, correlations between asset classes tend to rise significantly. No matter how an asset allocation portfolio is positioned, rising correlations can wreak havoc on performance. Thus, instead of diversifying by asset class alone, we believe that a more modernized approach to portfolio diversification is necessary - by strategy, by style, and by manager. Portfolio managers all come with their own unique investing biases that tend to permeate their methodologies whether they know it or not. Thus, we've created the Multi-Methodology Portfolios+ (MMP+), which blend together programs that span different investment methodologies, styles, time-frames, asset classes, and managers. No single program works at all times, especially as market environments change. However, we believe a multi-strategy approach may reduce portfolio variance, effectively helping to “smooth the ride” and provide clients a more stable investment experience.

The goals of the MMP+ Portfolios are simple:

1) Adapt to changing market environments.

2) Focus on market leadership.

3) Help manage the risk of the market.

4) Provide diversification by methodology, style, asset class, and manager.

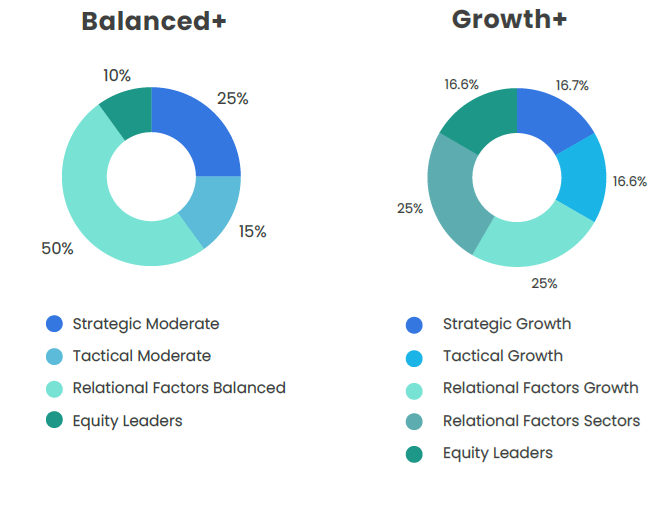

The MMP+ Portfolios are available at two risk levels: Balanced+ and Growth+.

MMP Balanced+ | Strategic / Tactical / Equity Blend | $500,000 Minimum | Managers: Ken Hartley, CFA; Don Moenning

The MMP Balanced+ portfolio is a multi-manager, multi-strategy blended model appropriate for moderate to moderately aggressive investors, consisting of 50% Relational Factors Balanced, 25% Strategic Moderate, 15% Tactical Moderate, and 10% Equity Leaders. The portfolio targets a 60% equity / 40% fixed income allocation, blending strategic, tactical, and individual equity investment styles to create a truly diverse, risk-managed approach for investors seeking a moderate risk profile. The MMP portfolios are designed for high-net worth individuals. Typical allocation: 60% Equity / 40% Fixed Income.

MMP Growth+ | Strategic / Tactical / Equity / Sector Rotation Blend | $500,000 Minimum | Managers: Ken Hartley, CFA; Don Moenning

The MMP Growth+ portfolio is a multi-manager, multi-strategy blended model appropriate for moderately aggressive to aggressive investors, consisting of 25% Relational Factors Growth, 25% Relational Factors Sectors, 16.7% Strategic Growth, 16.6% Tactical Growth, and 16.6% Equity Leaders. The portfolio targets an 80% equity / 20% fixed income allocation, blending strategic, tactical, sector rotation, and individual equity investment styles to create a truly diverse, risk-managed approach for investors seeking a moderately aggressive risk profile. The MMP portfolios are designed for high-net worth individuals. Typical allocation: 80% Equity / 20% Fixed Income.

Component Info Sheets: Relational Factors Info Sheet (PDF) | Strategic Info Sheet (PDF) | Tactical Info Sheet (PDF) | Equity Leaders Info Sheet (PDF) | Dividend Equity Info Sheet (PDF)