Tactical Allocation Strategies | Tactical Allocation | Minimum: $5,000 | Manager: Don Moenning | Info Sheet (PDF)

The Tactical Allocation Strategies are tactical, risk-managed models designed to provide appropriate asset allocations to current market conditions, adjusting accordingly as market environments change. Clarus offers three different Tactical portfolios, each targeting a different risk profile: Conservative, Moderate, and Growth.

The strategy utilizes a proprietary signaling model built to help define the current market environment. Once the environment has been determined, low-cost equity and fixed income index ETFs fill are selected to fill out appropriate exposures to suit the environment.

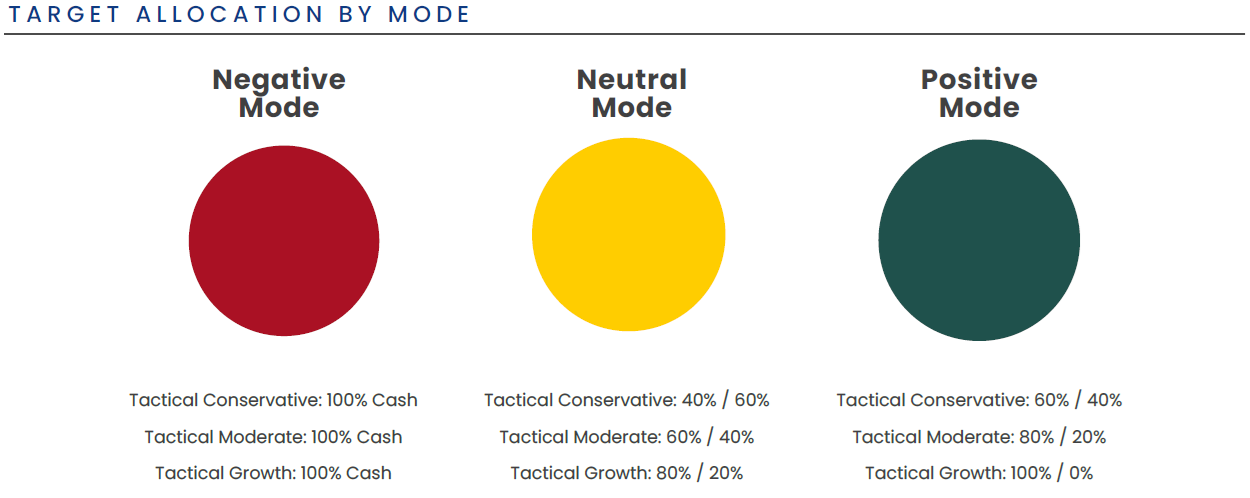

The primary goal of the Tactical portfolios is to be positioned in equities during positive environments (bull markets), utilize a reduced-risk profile in neutral environments, and hold cash and/or fixed income in negative environments (bear markets). The allocation varies by mode, and manager discretion is used to select the appropriate style-box exposure.

Tactical Conservative

The Tactical Conservative portfolio is a risk-managed, tactical portfolio designed to provide an appropriate asset allocation to current market conditions, adjusting accordingly as market environments evolve. The portfolio aims to be long equity in positive environments, in cash in negative environments, and hold a balanced mix of equity and fixed income in neutral environments. Environments are determined by a proprietary rules-driven model. The portfolio utilizes low-cost equity and fixed income index ETFs and/or open-ended fixed income mutual funds to fill out its exposures. The Tactical Conservative normally holds 40% fixed income regardless of the market environment to provide a conservative risk profile. Risk level is considered to be moderately conservative. Typical target allocations: Positive Market - 60% Equity & 40% Fixed Income; Neutral Market - 30% Equity & 40% Fixed Income & 30% Money Market; Negative Market - 40% Fixed Income & 60% Money Market.

Tactical Moderate

The Tactical Moderate portfolio is a risk-managed, tactical portfolio designed to provide an appropriate asset allocation to current market conditions, adjusting accordingly as market environments evolve. The portfolio aims to be long equity in positive environments, in cash in negative environments, and hold a balanced mix of equity and fixed income in neutral environments. Environments are determined by a proprietary rules-driven model. The portfolio utilizes low-cost equity and fixed income index ETFs to fill out its exposures. Risk level is considered to be moderately aggressive. Typical target allocations: Positive Market - 80% Equity & 20% Fixed Income; Neutral Market - 60% Equity & 40% Fixed Income; Negative Market - 100% Money Market.

Tactical Growth

The Tactical Growth portfolio is a risk-managed, tactical portfolio designed to provide an appropriate asset allocation to current market conditions, adjusting accordingly as market environments evolve. The portfolio aims to be long equity in positive environments, in cash in negative environments, and hold a balanced mix of equity and fixed income in neutral environments. Environments are determined by a proprietary rules-driven model. The portfolio utilizes low-cost equity and fixed income index ETFs to fill out its exposures. Risk level is considered to be aggressive. Typical target allocations: Positive Market - 100% Equity; Neutral Market- 60% Equity & 40% Fixed Income; Negative Market - 100% Money Market.