Relational Factors Strategies | Strategic Asset Allocation | Minimum: $50,000 | Manager: Ken Hartley, CFA | Info Sheet (PDF)

Clarus' Relational Factors Strategies offer a unique take on the strategic allocation management style. The primary objective of the series is to seek positive, risk-adjusted returns over market cycles. The portfolio construction process focuses on identifying positive relational opportunities and relative valuation assessment of the primary asset classes.

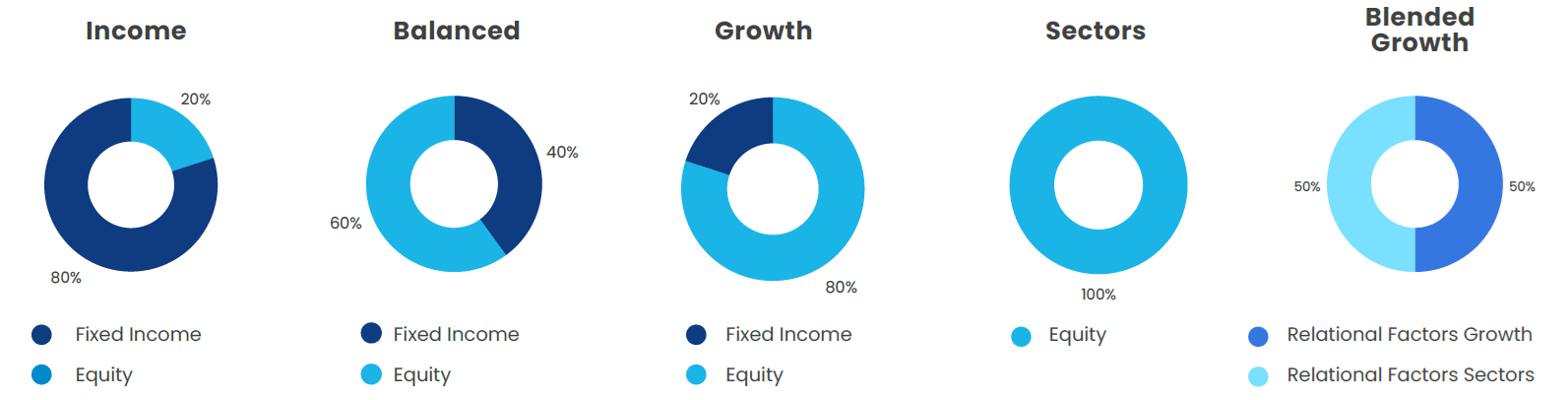

The objective of the Relational Factors Portfolios is to seek positive, risk-adjusted returns by determining how asset classes are valued relative to each other. The portfolios are constructed using an asset allocation process that seeks positive, risk-adjusted total returns. Clarus offers three risk levels - Income, Balanced, and Growth, as well as a Blended Growth option (50% Growth / 50% Sectors).

The objective of the Relational Factors Sectors Portfolio is to also seek positive, risk-adjusted returns, but differs by determining how asset classes are valued relative to each other. The portfolio is constructed using an asset allocation process that seeks market sectors that are out of favor or have underperformed relative to other sectors. The portfolio will be constructed to anticipate market rotation to the sectors that were previously mis-priced.

All asset classes are utilized through Exchange Traded Funds (ETFs) and a few, highly-rated mutual funds that replicate a particular asset class. ETFs provide a true asset class match without the “style-drift” of mutual funds and are generally a less expensive asset to use in portfolio construction. ETFs can also throughout the day, which helps in the event market volatility creates opportunity.

Based on market volatility, the portfolios will typically be rebalanced quarterly. Tax sensitivity will be considered in individual accounts but will not override the decision to rebalance.