Strategic Strategies | Strategic Asset Allocation | Minimum: $20,000 | Manager: Don Moenning | Info Sheet (PDF)

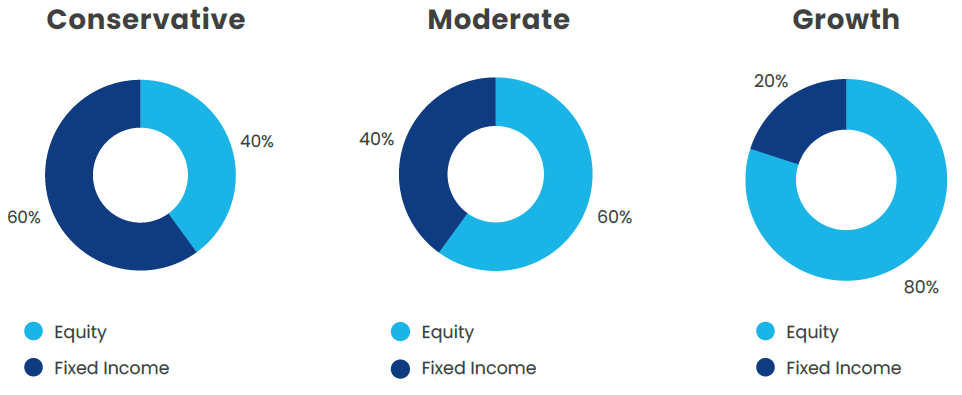

The Strategic portfolios are strategic asset allocation portfolios designed to deliver a balance of income and growth across varying risk profiles. Clarus offers three different Strategic portfolios: Conservative, Moderate, and Growth.

The Strategic portfolios take advantage of ETF and mutual fund investments to achieve exposures to different asset classes, ultimately adding value through the selection of these funds and the allocations assigned to each. The portfolios seek a mix of domestic equity, international equity, and diversified fixed income exposure, with weightings to each category assigned to target specific risk profiles. The portfolios aim to add value through fund selection and asset allocation tilting, utilizing manager discretion to position clients favorably for the current market.

The Strategic portfolios are rebalanced on a discretionary/opportunistic basis, with fund selection reviews and asset allocation reviews taking place on a quarterly basis. Allocations are built to be closely competitive to each portfolio’s targeted benchmark. The appropriate investing time frame is generally 3-5 years.

Strategic Conservative (40% Equity / 60% Fixed Income)

The Strategic Conservative portfolio is a strategic asset allocation portfolio designed to deliver modest capital growth and moderate income. The portfolio utilizes ETF and mutual fund investments to deliver diversified allocations to domestic equity, international equity, and fixed income, adding alpha through fund selection and asset allocation tilting. Risk level is considered to be conservative. Typical allocation: 40% Equity | 60% Fixed Income.

Strategic Moderate (60% Equity / 40% Fixed Income)

The Strategic Moderate portfolio is a strategic asset allocation portfolio designed to deliver moderate capital growth and modest income. The portfolio utilizes ETF and mutual fund investments to deliver diversified allocations to domestic equity, international equity, and fixed income, adding alpha through fund selection and asset allocation tilting. Risk level is considered to be moderate. Typical allocation: 60% Equity | 40% Fixed Income.

Strategic Growth (80% Equity / 20% Fixed Income)

The Strategic Growth portfolio is a strategic asset allocation portfolio designed to deliver long-term capital growth. The portfolio utilizes ETF and mutual fund investments to deliver diversified allocations to domestic equity, international equity, and fixed income, adding alpha through fund selection and asset allocation tilting. Risk level is considered to be moderately aggressive. Typical allocation: 80% Equity | 20% Fixed Income.