STS & MMP Portfolios | Multi-Strategy Blended Portfolios

In times of market stress, correlations between asset classes tend to rise significantly. No matter how an asset allocation portfolio is positioned, rising correlations can wreak havoc on performance. Thus, instead of diversifying by asset class alone, we believe that a more modernized approach to portfolio diversification is necessary. The Clarus Sleeve-Traded Solutions (STS) and Multi-Methodology Portfolios (MMP) blend together programs that span different investment methodologies, styles, time-frames, and asset classes. No single program works at all times, especially as market environments change. However, we believe a multi-strategy approach may reduce portfolio variance, effectively helping to “smooth the ride” and provide clients a more stable investment experience.

The goals of the STS & MMP blended strategies are simple:

1) Adapt to changing market environments.

2) Focus on market leadership.

3) Help manage the risk of the market.

4) Diversify by methodology, style, and asset class.

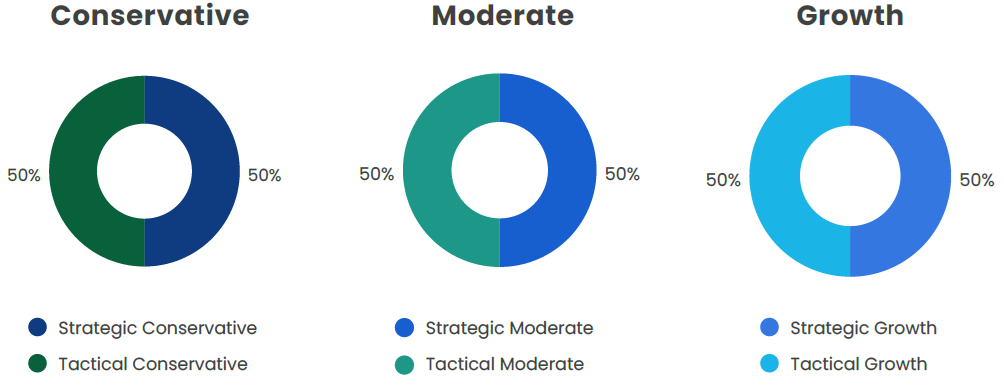

STS Portfolio Series | Strategic / Tactical Blend | $40,000 Minimum | Manager: Don Moenning | Info Sheet (PDF)

The STS portfolio series blends the Strategic and Tactical models together at a 50% / 50% blend. The primary benefit of this approach is to allow participation in the market at a targeted risk level while simultaneously striving to manage market risk, all at a relatively low investment minimum. Clarus offers three STS portfolio risk levels: Conservative, Moderate, and Growth.

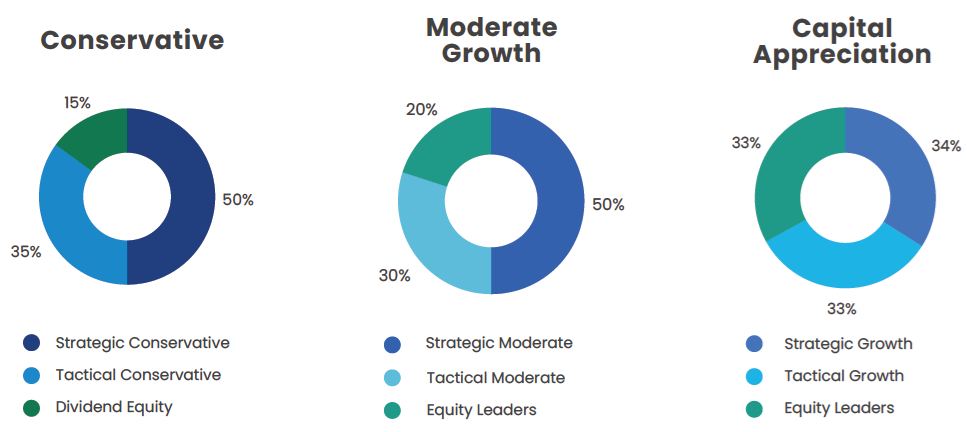

MMP Portfolio Series | Strategic / Tactical / Equity Blend | $250,000 Minimum | Manager: Don Moenning | Strategic Info Sheet (PDF) | Tactical Info Sheet (PDF) | Equity Leaders Info Sheet (PDF) | Dividend Equity Info Sheet (PDF)

The MMP series carries a higher investment minimum than the STS series, as it takes diversification one step further with the inclusion of individual equity programs in the existing STS blends. The result is a multi-strategy portfolio with three programs blended together, providing strategic, tactical, and equity investment styles. The MMP series is aimed towards higher net worth clients and/or clients looking to own individual stocks along with a blended allocation of broad-market exposure programs. Clarus offers three MMP portfolio risk levels: Conservative, Moderate Growth (Moderate), and Capital Appreciation (Growth).